The International Air Transport Association (IATA) has just released its 2024 World Air Transport Statistics (WATS)—drawing from data across more than 240 airlines, offering comprehensive insights into the passenger and cargo markets, aircraft fleets, capacity, and more.

The Middle East and its airlines stood out

- Passenger traffic surged 9.4% year‑on‑year in 2024, outpacing global average growth (9.4% vs. ~11.5%) while load factor climbed by 0.7 points to reach 80.8%, signaling high efficiency.

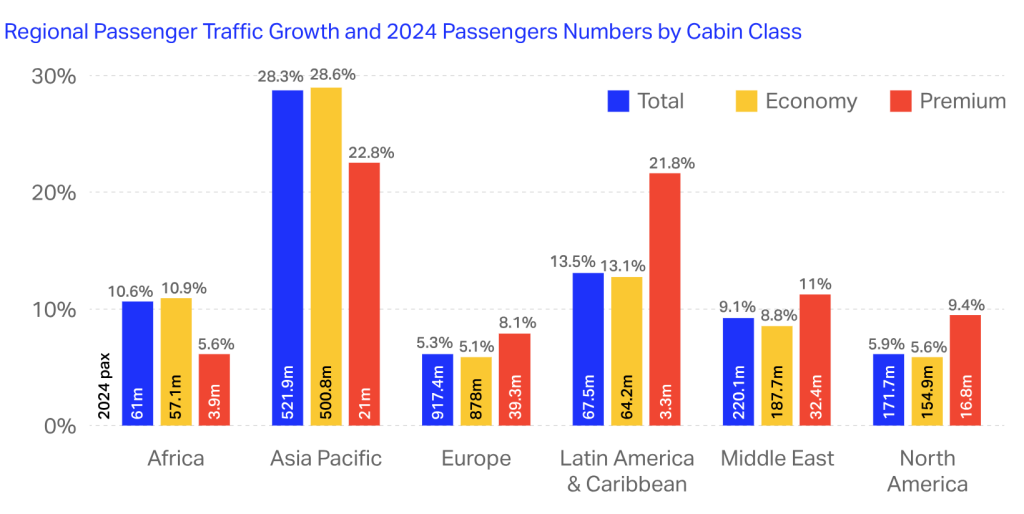

- Premium‑class travel (business & first class) growth slightly exceeded economy passenger growth globally. Notably, the Middle East region reported the highest share of premium travellers at 14.7% of international traffic, underscoring Gulf carriers’ strength in serving upscale markets.

- Air cargo demand for Middle Eastern carriers rose by 13% in 2024, outpacing global demand growth of 11.3%. Their cargo market share stood at 13.6% of international cargo traffic, driven by strong e‑commerce growth and strategic routing advantages.

Why Middle Eastern airlines are performing remarkably

1. Premium service that delivers

Carriers like Emirates, Qatar Airways, and Etihad are globally renowned for luxurious cabins and seamless hubs that attract premium travellers, which is clearly reflected in the 14.7% premium passenger share.

2. Strategic hub advantage

From Dubai to Doha and Abu Dhabi, these hubs sit at one of the world’s most geographically advantaged crossroads, connecting Europe, Asia, Africa, and the Americas with efficient routing and multiple daily connections.

3. Cargo prowess in turbulent times

When maritime disruptions and regional security risks diverted container ships, carriers like Emirates SkyCargo and Qatar Airways Cargo stepped in to handle high-value, time-sensitive freight, thus boosting cargo demand and yields.

4. Economic engine and regional connectivity

Aviation in the Middle East supports US $290 billion in GDP and more than 4 million jobs (that’s about one in every 20 jobs), which speaks to the industry’s regional importance.

5. Resilience amid geopolitical shifts

Despite regional tensions causing airspace closures and longer flight routings, Middle Eastern airlines have often maintained more direct and shorter route options compared with Western rivals, giving them both cost and competitiveness advantages.

What’s the outlook?

There’s no question the Middle East aviation industry is experiencing a premium take-off, with business and first-class international travel increasing by 11.8%. This growth is slightly ahead of economy class, which saw an 11.5% increase, driven by corporate and high-net-worth travellers in the region.

In terms of fleet evolution, narrow-body jets like Boeing 737s and Airbus A320s continue to dominate GCC feeder routes. However, some airlines are signaling a shift towards rapid wide-body growth. For example, Saudi’s Riyadh Air has placed a large order for Boeing 787-9s, while Ethiopian Airlines is expanding its fleet to 271 jets by 2035.

Despite the growth, the industry is facing operational headwinds. IATA has flagged increasing strain from missile threats, airspace bans, and rerouting. While Middle Eastern carriers benefit from relatively unhindered airspace, broader regional instability still weighs on planning and costs.

One thing’s for certain, and that is Middle Eastern airlines are setting the global pace. With strong premium travel demand, robust cargo operations, world‑class hubs, and economic impact, major carriers from the region are already redefining the global aviation landscape.